Unicorns aren’t dead yet, though some would like them to be. Others claim we’re now in a “post-unicorn” world. Whatever the future holds, the class of $1B+ private companies continues to expand and contract weekly – providing a valuable microcosm to understand today’s tech trends and startup dynamics.

To that end, we’re launching the first complete study that benchmarks visibility and momentum for 145 unicorns across news, social and search channels. This is especially relevant because startups need “out-sized” visibility to attract customers and prospects, and they need to demonstrate momentum for recruiting top talent and investors.

We built our unicorn list based on three primary sources: Dow Jones VentureSource; CB Insights; and CrunchBase. We then used specialized media analysis tools to track monthly News, Social and Search volumes for each company. Finally, we applied our Earned Media Index™ methodology to aggregate performance for easy comparison of visibility and momentum over time.

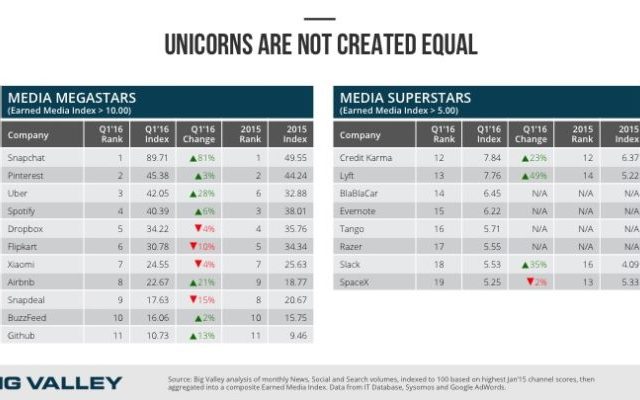

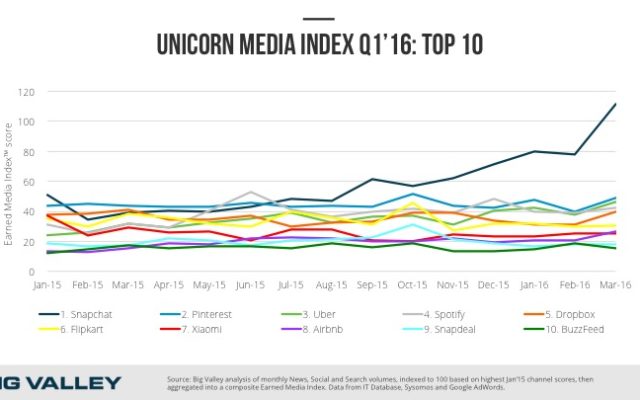

As we learned in our study of 75 unicorns, it’s clear that unicorn status and valuation alone do not dictate media performance. Some “megastars” and “superstars” rise above the herd. Some grew their visibility in Q1 while others declined. And all are impacted by a mix of category performance, company success factors and channel dynamics. Key findings include:

- Snapchat breaks out as runaway social media phenomenon

- Snapchat (#1 earned media, #7 valuation) is up 81% over 2015, nearly doubles #2 Pinterest

- Uber jumps up to #3 ranking in otherwise stable top 12

- Pinterest (#2 earned media, #11 valuation) stays a strong second with 3% increase over 2015

- Uber (#3 earned media, #1 valuation) moves up from #6 with 28% increase in earned media

- Airbnb (up 21%) and Snapdeal (down 15%) swap positions at #8 and #9

- Rankings are led by 11 “megastars,” 8 “superstars” and 22 “stars”

- Megastars and superstars averaged a 15% increase in Q1’16, with 10 risers and 5 decliners

- Media stars likewise averaged a 26% increase, with 8 risers and 5 decliners

- Valuation influences but doesn’t dictate earned media performance

- Docker, Zomato Media and 8 others out-performed their valuation ranking by 70+ positions

- Eight of the 10 significant under-performers are Chinese firms with limited global visibility

Other company moves to note include:

- Github led the B2B pack to become a “megastar” in Q1, fueled by its developer fan base

- Slack added 35% in Q1 to graduate from “star” to “superstar” – another B2B standout

- Zenefits grew 93% on CEO resignation, compliance investigation and “sex in the stairwell”

- Theranos also grew 56% on bad news, including 57 monthly news stories (vs. 34/month in 2015)

- DJI declined 39% on drone fatigue, while Magic Leap jumped 73% on virtual reality buzz

Here’s the full study for your data-loving exploration. We look forward to your feedback…